Medicare tax calculation 2023

For 2024 IRMAA your forecast is 101000 with zero inflation from now till August 2023. Understanding what propelled the 2022 premium increase can give you a sense of what to expect in 2023.

Cola 2023 Projection Of The Increase In The Social Security Check For 2023 Marca

You need to consider your eligibility for a reduction or an exemption separately.

. The standard Part B monthly premium in 2021 was 14850 and in 2022 the amount increased to 17010. Begin tax planning using the 2023 Return Calculator below. Your total FICA tax rate equals 153 of your wages with the other 124 of your salary going to Social Security.

26 2013 the IRS issued final regulations TD 9645 PDF implementing the Additional Medicare Tax as added by the Affordable Care Act ACA. 20 of the Medicare-approved amount for durable medical equipment like wheelchairs walkers hospital beds and other equipment Hospice care. Monthly Medicare Premiums for 2022.

After age 65 you are only penalized by the taxable portion of social security for Medicare. Refer to Publication 15 Circular E Employers Tax Guide for more information. In 2021 the Medicare tax rate is 145.

Ad Search top Medicare plans in your area. If you dont see your situation contact Social Security or the Railroad Retirement Board if you get railroad benefits to learn more about your specific eligibility or premium. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Tax Planning Consideration for IRMAA 2023. 2021 Tax Calculator Exit. This calculator is integrated with a W-4 Form Tax withholding feature.

You can use the Medicare levy calculator. Today the Centers for Medicare Medicaid Services CMS released the Announcement of Calendar Year CY 2023 Medicare Advantage MA Capitation Rates and Part C and Part D Payment Policies the Rate Announcement. The current rate for Medicare is 145 for the employer and 145 for the employee or 29 total.

116117638 net salary is 202352000 gross salary. 126147503 net salary is 202300500 gross salary. 2023520 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations.

2023005 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. Medicare Advantage plans as low as 0month. Calculate Your 2023 Tax Refund.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Estimate my Medicare eligibility premium. Form 8960 Net Investment.

Check out our chart on the different parts of Medicare explained. This Tax Calculator Lets You Estimate Your Taxes. Calculate your tax and after tax salary Enter your taxable income in dollars.

As you begin the process of filing 2021 taxes you should be aware that what goes on a completed Form 1040 will have an impact on what premiums you will be paying in 2023. The standard Part B premium for 2022 is 17010. 2021 Medicare tax rate.

What is a 202352k after tax. Whats The Current Medicare Tax Rate. Are you ready for a change.

Form 1040 Schedule 8812 Child Tax Credit. Heres what you need to know. In a report to Becerra the agency said the premium recommendation for 2022 would have been 16040 a month had the price cut and the coverage determination both been in place when officials calculated the figure.

Based on your forecast It is pretty sure that the 2023 IRMAA will be around 97000 or 98000 for individual or MFS. The premium for 2023 for Medicares more than 56 million recipients will be announced in the fall. If you are self-employed you are responsible for the full 29.

This is the amount youll see come out of your paycheck and its matched with an additional 145 contribution from your employer for a total of 29 contributed on your behalf. Social Security and Medicare Withholding Rates. 0 for covered home health care services.

Modified Adjusted Gross Income MAGI Part B monthly premium amount. 19450 copayment each day. This Tax Return and Refund Estimator is currently based on 2022 tax tables.

Form 8959 Additional Medicare Tax. Get an estimate of when youre eligible for Medicare and your premium amount. Form 8960 Net Investment Income TaxIndividuals Estates and Trusts.

If youre single and filed an individual tax return or married and filed a joint tax return the following chart applies to you. Days 101 and beyond. Self-employed people are allowed to deduct their health insurance premiums on Schedule 1 of the 1040 form as an above the line deduction which lowers their.

The Medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income. The Medicare tax rate is 29 of your income. Estimate in 2022 and e-File in 2023.

TaxCalc has now been updated following the 2022 Federal Budget. Based on the Information you entered on this 2021 Tax Calculator you may need the following 2021 Tax Year IRS Tax Forms to complete your 2021 IRS Income Tax Return. Still only the taxable portion of social security is added back on the MAGI calculation for Medicare.

Pundits are suggesting premiums will decrease for 2023. You pay all costs. IT is Income Taxes.

You may get a reduction or exemption from paying the Medicare levy depending on your and your spouses circumstances. We dont store your information. Also calculates your low income tax offset HELP SAPTO and medicare levy.

So before 65 if you want premium ACA tax credits you dont want to file for social security. Self-employed people are. What is a 202301k after tax.

Tax and salary calculator for the 2022-2023 financial year. CMSs goals for Medicare Advantage and Part D mirror our vision for the agencys programs as a whole which is to advance health. The Additional Medicare Tax applies to wages railroad retirement RRTA compensation and self-employment income over certain thresholds.

Following your calculation method if inflation is -2 the 2024 IRMAA will be 100000. Form 8959 Additional Medicare Tax. Employers are responsible for withholding the tax on.

If you work for an employer you pay half of it and your employer pays the other half 145 of your wages each.

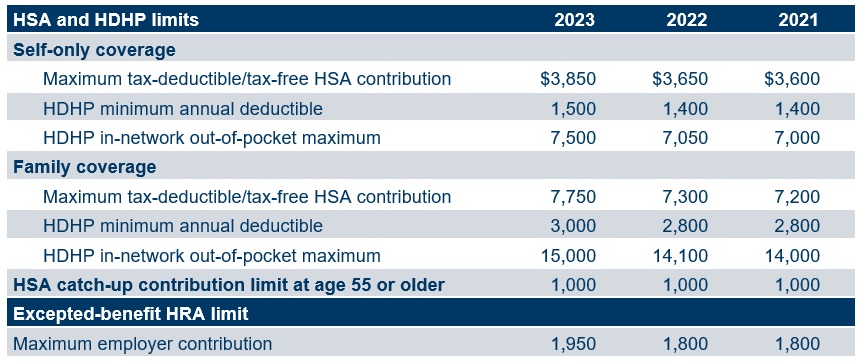

2023 Hsa Hdhp And Excepted Benefit Hra Figures Set Mercer

![]()

Inflation Enhances The 2023 Amounts For Health Savings Accounts

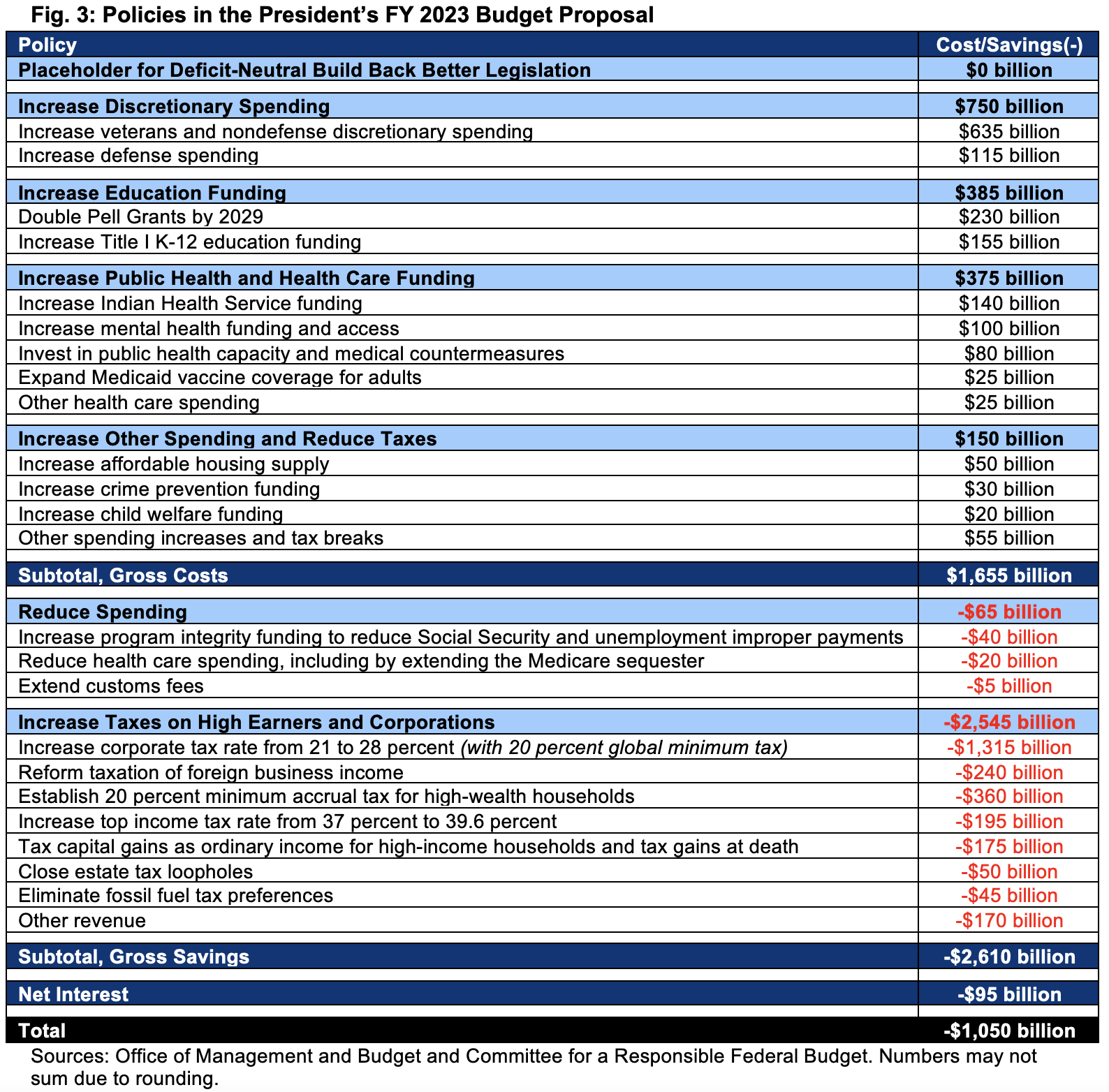

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

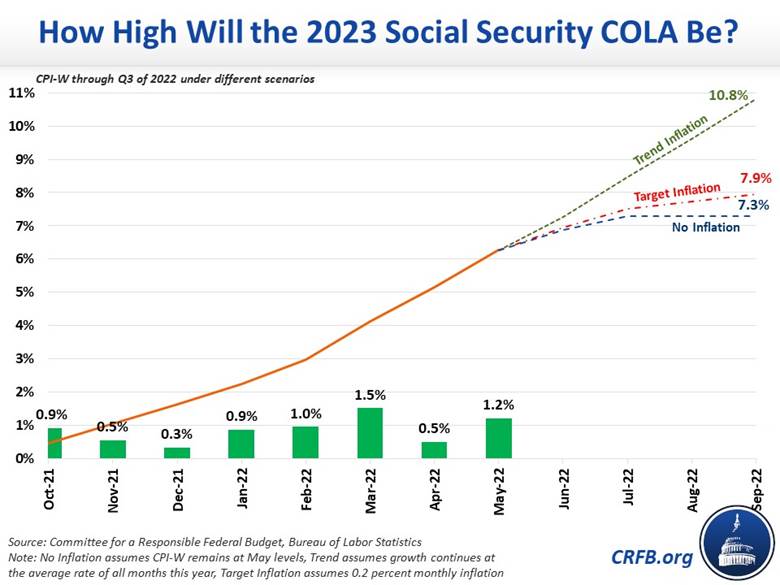

Could 2023 Social Security Cola Hit 9 Benefitspro

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

You Won T Believe The Size Of This 2023 Social Security Cola Estimate 401 K Specialist

Biden Administration S 2023 Tax Policy Includes Many Key Changes For Crypto Traders And Investors

Medicare And Taxes How Your 2023 Medicare Premiums Are Affected By Your 2021 Tax Filing Gobankingrates

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

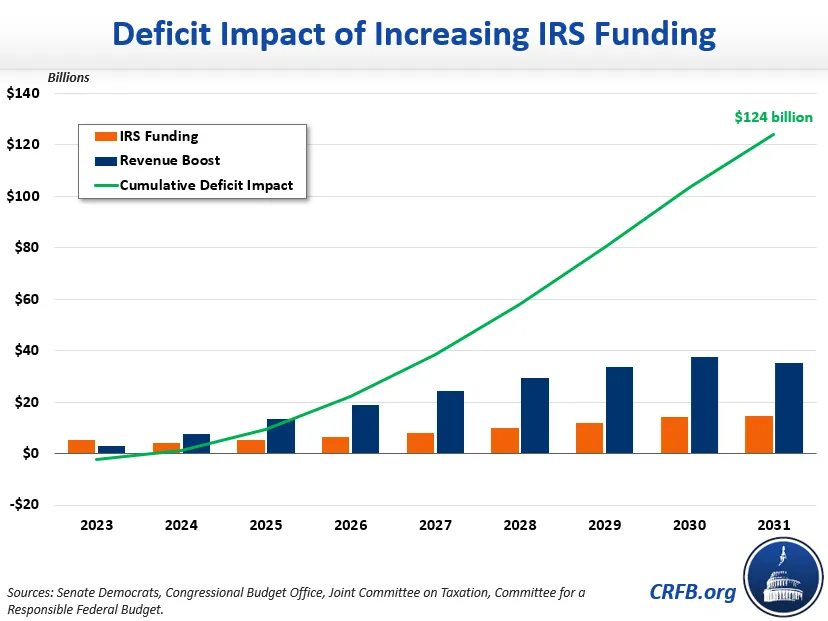

The Inflation Reduction Act Would Reduce The Tax Gap Committee For A Responsible Federal Budget

4 Social Security Changes To Expect In 2023 The Motley Fool

Social Security Benefits 2023 When Will The Cola Increase Be Decided Marca

Biden S 5 79 Trillion 2023 Budget Proposal Would Also Expand Regulation

Why A Record Cola Increase In 2023 Could Backfire On Seniors

2023 Lexus Rx Adds Turbos Electrical Power

Social Security What Is The Wage Base For 2023 Gobankingrates