Bond compound interest calculator

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. You will have to input the principal amount the frequency of compounding your investment tenure and the expected rate of return.

Capitalize On Uninterrupted Compound Interest Wealth Nation

Predetermined lump sum paid at loan maturity the face or par value of a bond.

. After a user enters the annual rate of interest the duration of the bond the face value of the bond this calculator figures out the current price associated with a specified face value of a zero-coupon bond. FV future value. Use the Compound Interest Calculator to learn more about or do calculations involving compound interest.

The coupon rate is the annual interest the bond pays. Treasury savings bonds pay out interest each year based on their interest rate and current value. Find out the initial principal amount that is required to be invested.

A conservative approach to bond investing is. FV PV 1 rn nt. If a bond with a par value of 1000 is paying you 80 per year then the coupon.

With a fixed-rate bond the interest is paid according to an exact agreed-upon rate and. Bond prices tend to drop as interest rates rise and they typically rise when interest rates fall. Explained With Calculations and Examples.

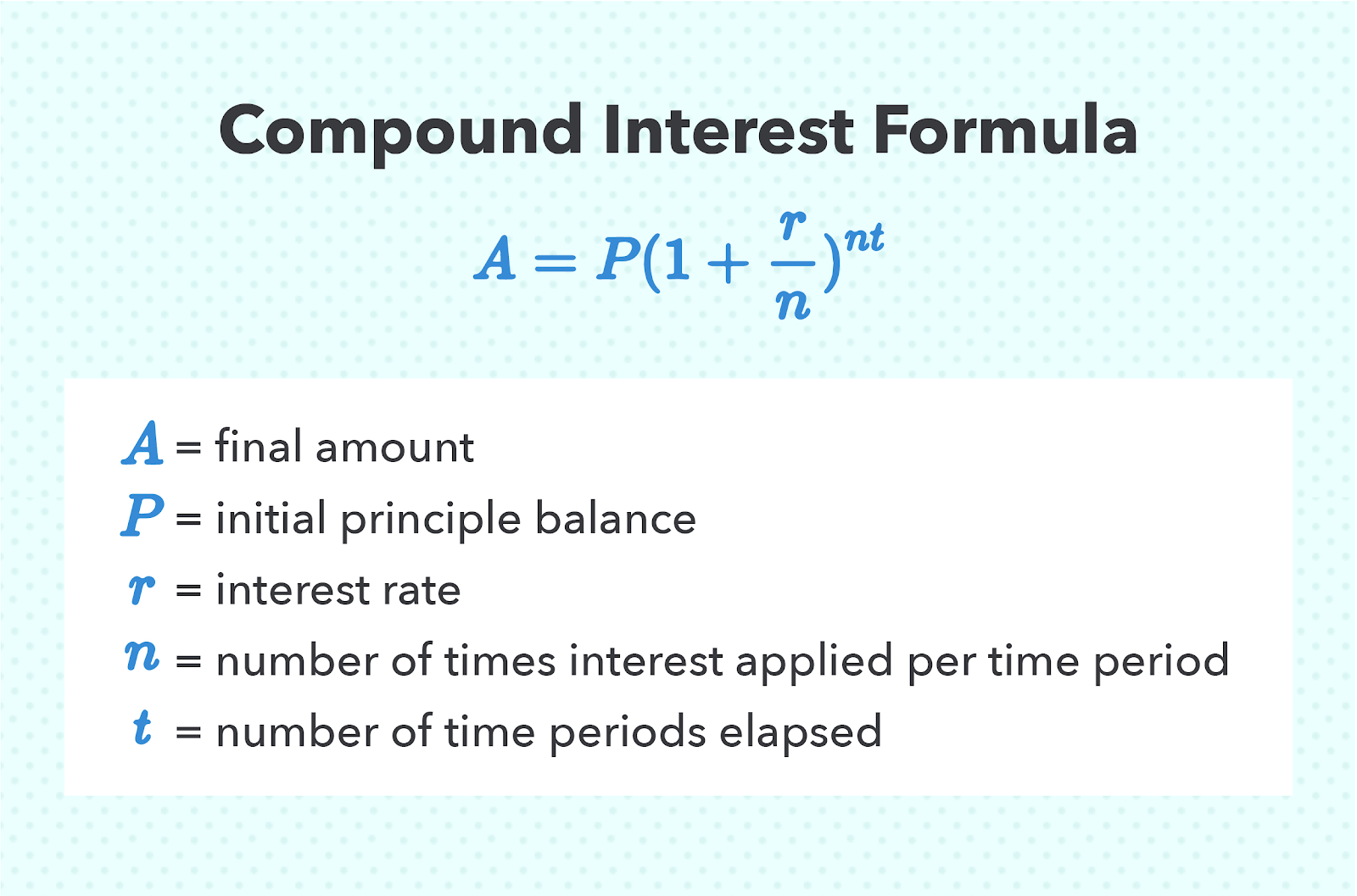

Within different parts of the bond market differences in supply and demand can also generate short-term trading opportunities. Thought to have. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and. Savings bonds are issued by the US. With links to articles for more information.

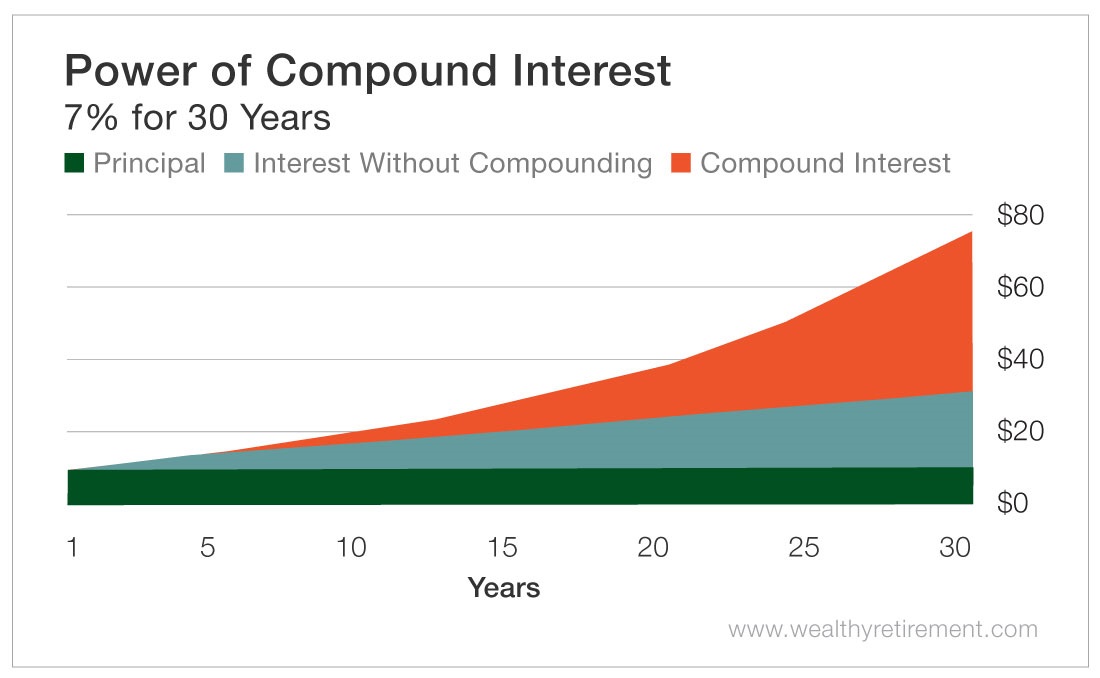

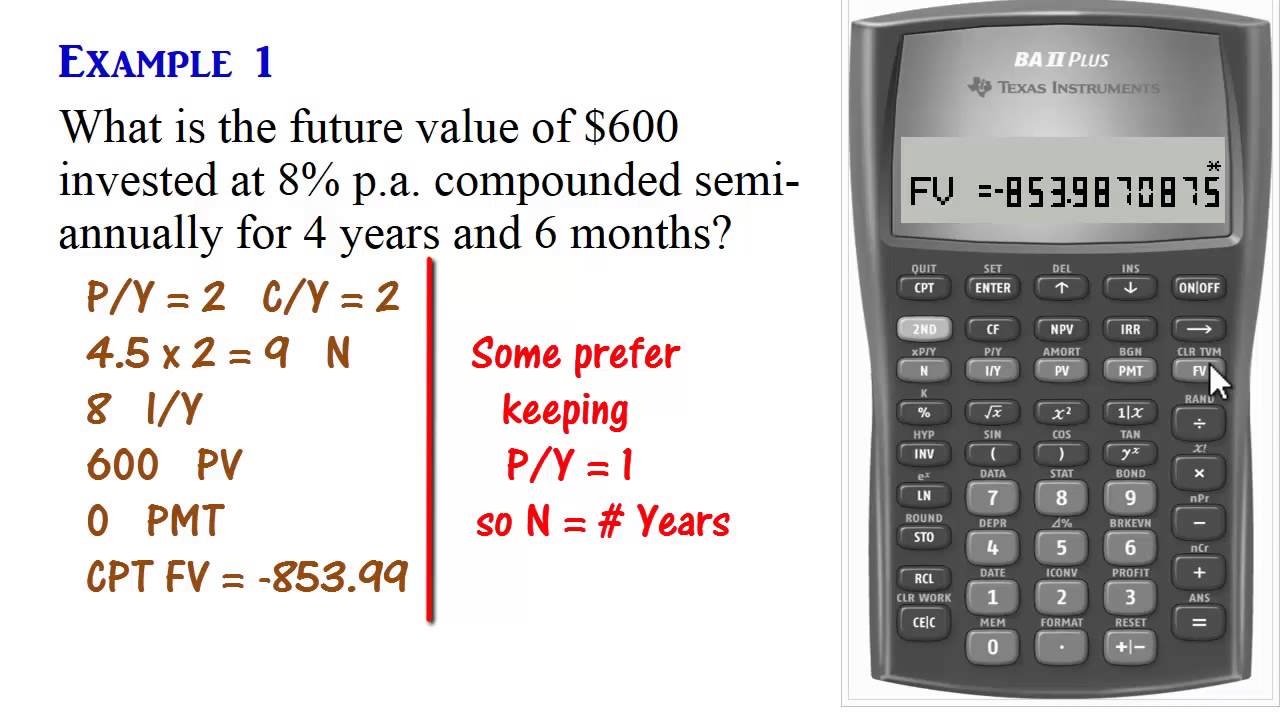

The current yield of a bond is also referred to as the flat yield interest yield income yield or even the running yield and the definition of current yield is really the same as for all of the terms. Interest is compounded semi-annually throughout the duration or at the end of each fraction of a half-year for any fractional years. Calculate interest compounding annually for year one.

Explore personal finance topics including credit cards investments identity. Assume that you own a 1000 6 savings bond issued by the US Treasury. If you receive payments semi-annually enter 2.

Using the Bond Price Calculator Inputs to the Bond Value Tool. This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value coupon rate market rate interest payments per year and years-to-maturity. You can learn more about supercharging your retirement.

As the prior example shows the value at the 6 rate with 5 years remaining would be 7473. Interest paid in year 1 would be 60 1000 multiplied by 6 60. This calculator shows the current yield and yield to maturity on a bond.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. In this example we suppose that the interest rates have changed to 5 since it was originally issued.

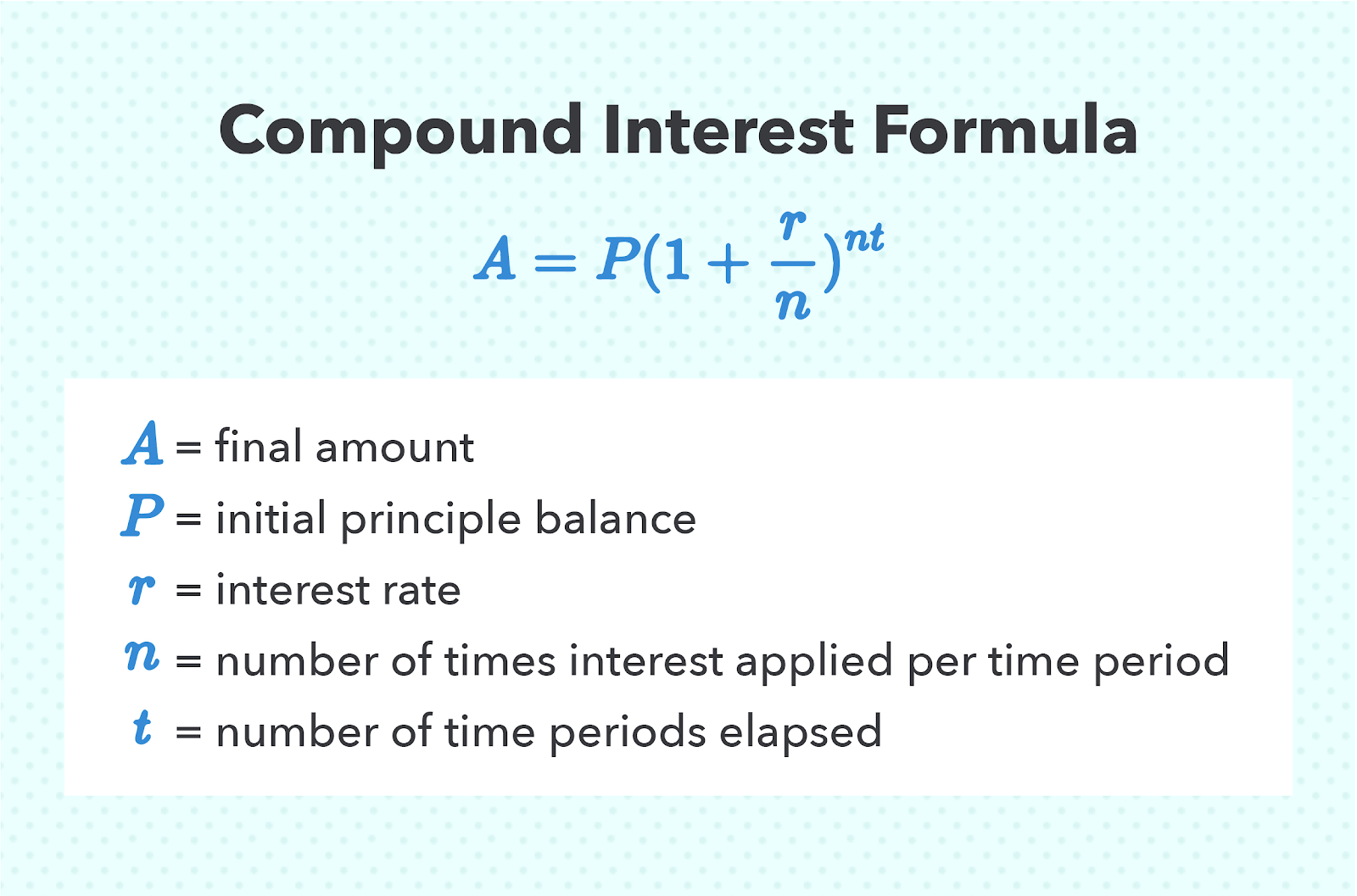

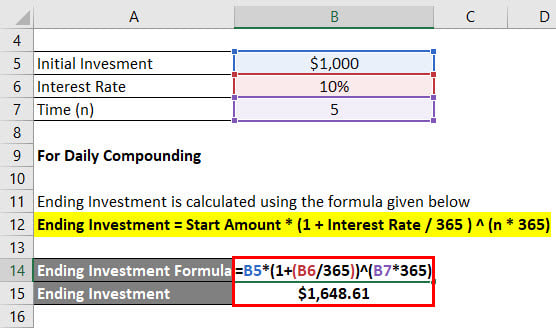

To compute compound interest we need to follow the below steps. The above calculator automatically does this for you but if you wanted to calculate compound interest manually the formula is. A loan term is the duration of the loan given that required minimum payments are made each month.

The treasury bond calculator exactly as you see it above is 100 free for you to use. If the bond pays interest once a year enter 1. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond.

Enter 4 for a bond that pays quarterly. Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually. This lets us find the most appropriate writer for any type of assignment.

Also be sure and check out our bond value calculator and our many other financial calculators. Treasury and reliably build value over time. The bond pays out 21 every six months so this means that the bond pays out 42 every year.

Bond Face ValuePar Value - Par or face value is the amount a bondholder will get back when a bond matures. Compound interest is when the interest you earn on a balance in a savings or investing account is reinvested earning you more interest. To use our free Bond Valuation Calculator just enter in the bond face value months until the bonds maturity date the bond coupon rate percentage the current market rate percentage discount rate and then press the calculate button.

The term of the loan can affect the. Here we discussed how to calculate Daily Compound Interest with examples Calculator and excel template. The current market price of the bond is how much the bond is worth in the current market place.

In reverse this is the amount the bond pays per year divided by the par value. Bond Yield Formulas See How Finance Works for the formulas for bond yield to maturity and current yield. Compound interest is a powerful concept and it applies to many areas of the investing world.

As a bond purchaser or bondholder you are compensated for your investment in the form of interest which is added to the value of the bond according to various schedules eg. Guide to Daily Compound Interest Formula. The formula would be shown as.

Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. The compound interest calculator displays the results as the maturity amount at the end of investment tenure. You just bought the bond so we can assume that its current market value is 965.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. The compound interest calculator online works on the compound interest formula. Our compound interest calculator above limits compounding periods to 100 within a year.

A 6 year bond was originally issued one year ago with a face value of 100 and a rate of 6. Click the Customize button above to learn more. As a wise man once said Money makes money.

PV present value initial deposit r annual interest rate as a decimal rather than percent also called APR n number of times interest is. Compound Interest Explanation. Compound Interest Present Value Return Rate CAGR Annuity.

Compound Interest Formula And Financial Calculator Excel Template

Compound Interest Formula With Graph And Calculator Link

Compound Interest Definition Formula How It S Calculated

Compound Interest Formula And Financial Calculator Excel Template

Compound Interest Calculator Daily Monthly Yearly

Compound Interest Calculator Daily Monthly Quarterly Annual

Effective Interest Rate Formula Calculator With Excel Template

Compound Interest Calculator Set Your Own Compounding Periods

Ba Ii Plus Calculator Compound Interest Present Future Values Youtube

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Compound Interest Formula With Calculator

Daily Compound Interest Formula Calculator Excel Template

Compound Interest Formula Types Examples How To Calculate Compound Interest Video Lesson Transcript Study Com

Simple Interest Calculator Audit Interest Paid Or Received

Daily Compound Interest Formula Calculator Excel Template

Casio Graphic Display Calculator Financial Math 2 Compound Interest Youtube

Compound Interest Formula And Financial Calculator Excel Template